Simplified Investing vs Traditional Investing

Zero emotions involved

simplified investing systems minimize emotions thus doing away with bias, hesitation and confusionTried and Tested

simplified investing systems are a result of decades of experience and researchSaves time, Time is money

Interested in investing but don’t have the time to commit to it. A simplified system allows you to still participate in the market even if you don’t have the time for it

Choose the product that suits you

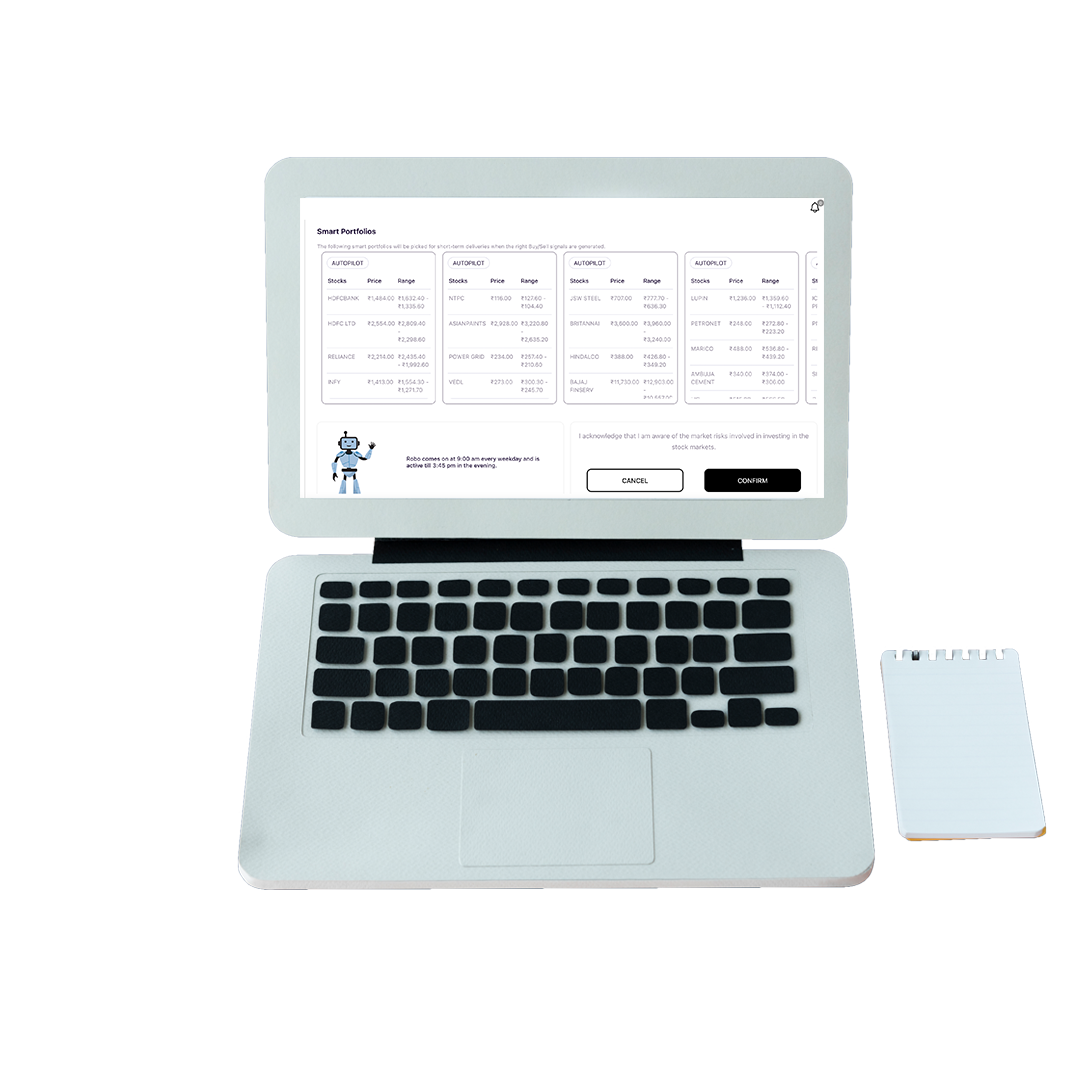

Smart Portfolio

- Start from only ₹ 50,000

- Short-term delivery based trades + intraday trading, 70:30 split

- Zero brokerage on delivery and intraday

- Platform fee as low as ₹ 200 per month

- Stocks picked from BSE top 100 stocks

Systematic Equity Investment Plan (SEIP)

- Start from as low as ₹ 5000

- Long-term recurring investing

- Zero brokerage on delivery

- Zero platform fee

- Stocks picked from BSE top 100 stocks

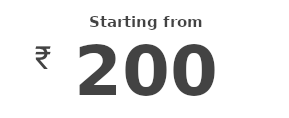

Unbeatable Pricing?

Simplified and Transparent Structure. Flat fees, No hidden charges.

Free equity delivery

Free intraday

starting from

Monthly Fees

First 3 months free

FAQs

Frequently Asked Questions

TRDR is a platform that helps you invest in the stock market through picking the research driven

TRDR Smart Portfolio. With your approval, TRDR executes stock purchases automatically when the price

is right.

During the TRDR sign up process, we set up a new demat + trading account with a SEBI registered broker. Once you transfer the amount to invest, you can set the TRDR Robo mode on. This allows TRDR to execute the stock purchase based on the right stock price point.

Once you invest, you can track your portfolio performance through the TRDR web / mobile dashboard. This makes investing in the stock market simple, without the need for your constant attention. Robo-driven.

During the TRDR sign up process, we set up a new demat + trading account with a SEBI registered broker. Once you transfer the amount to invest, you can set the TRDR Robo mode on. This allows TRDR to execute the stock purchase based on the right stock price point.

Once you invest, you can track your portfolio performance through the TRDR web / mobile dashboard. This makes investing in the stock market simple, without the need for your constant attention. Robo-driven.

Go to the TRDR Sign up page to create account. You will have to complete the KYC steps which are

similar to popular discount broker processes if you already have used. Once you sign up, within

24-48 hrs we will set up a demat + trading account with a SEBI registered stock broker - Federal

Capital Markets Limited (FCML).

You will need to keep soft copy (image/pdf files) of the following as you will be asked to upload:

- PAN Card

- Cancelled Bank Check / latest bank statement (this is the primary bank account linked to TRDR that you will be using to transfer/withdraw funds)

- Your signature on a white paper

- You will need a camera on the device you are using for sign up: you will be required to click a clear selfie.

- You will have to allow access for location sharing on your device: you will be required to share it as part of KYC requirements

- You need to keep handy your Aadhaar number + mobile number linked to it: you will receive an OTP

- Once your account is ready, Sign in to your TRDR Dashboard.

- Click the Robo Mode button to turn it on.

- Review and access the TRDR Smart Portfolios - BSE Top 100 stocks and their current price and price range.

- TRDR smartly diversifies to pick a balanced portfolio of stocks across various industries.

- You can now transfer funds to wish to invest - currently the minimum recommended investment amount is ₹50,000.

The minimum investment amount is ₹ 50,000. This will enable the Robo to have enough funds to

automatically allocate across a diverse portfolio of stocks across industries.

Current investment slabs:

Current investment slabs:

- Early: ₹50,000 - ₹2,00,000

- Basic: ₹2,00,001 - ₹5,00,000

- Pro: > ₹5,00,000

There is no sign up fee.

We are a zero brokerage platform. All equity delivery investments and intraday trades (BSE), are absolutely free — ₹ 0 brokerage.

We charge a monthly platform fee from you based on your investment amount.

We are a zero brokerage platform. All equity delivery investments and intraday trades (BSE), are absolutely free — ₹ 0 brokerage.

We charge a monthly platform fee from you based on your investment amount.

- Early: ₹50,000 - ₹2,00,000; Fee = ₹200 per month

- Basic: ₹2,00,001 - ₹5,00,000; Fee = ₹300 per month

- Pro: > ₹5,00,000; Fee = ₹400 per month

Robo-investing is the process by which you the investor can benefit from strategies prepared by

experienced professionals along with the speed and accuracy of software to execute trades - intraday

and short-term delivery-based. This is with zero manual effort or screen time from you.

Yes, robo-investing is legal in India. We have all the necessary license and approval to provide the

service to you in India.

No, as we will need to hold the Demat Account (through our partner stock broker) to easily execute

selling of short-term delivery-based trades without friction.

However, we are planning to work with various entities who provide Demat services like banks and stock brokers to embed our Robo TRDR. We will update you when we have that.

However, we are planning to work with various entities who provide Demat services like banks and stock brokers to embed our Robo TRDR. We will update you when we have that.

Yes, your money is safe with TRDR. It is as safe as any other stock broker in India. This is because

your money is held with Federal Capital Markets Limited (FCML). Your money is not transfered to the

TRDR bank account but directly to the FCML bank account to start investing.

FCML is a SEBI registered stock broker with a BSE membership. The broker has all the genuine certifications to conduct the broking business. The transactions of the broker get scrutinized by SEBI and stock exchanges at a regular frequency.

FCML being a member of the CDSL depository, the Demat account safety is taken by CDSL and the broker acts as a mere facilitator for the transfer of securities.

FCML is a SEBI registered stock broker with a BSE membership. The broker has all the genuine certifications to conduct the broking business. The transactions of the broker get scrutinized by SEBI and stock exchanges at a regular frequency.

FCML being a member of the CDSL depository, the Demat account safety is taken by CDSL and the broker acts as a mere facilitator for the transfer of securities.

You can view that on the TRDR Dashboard.

No, there is no lock-in period. However, early or abrupt withdrawals could mean that you are not

fully able to extract the profit potential and could impact the returns.